This article is a continuation of Part I of Decoding Indian Accounting Standard (Ind AS) - 12 which can be accessed here.

Recognition of Current Tax Liabilities and Current Tax Assets

Recognition of Deferred Tax Liabilities (DTL) and Deferred Tax Assets (DTA)

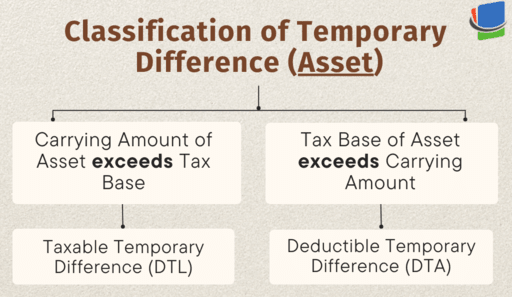

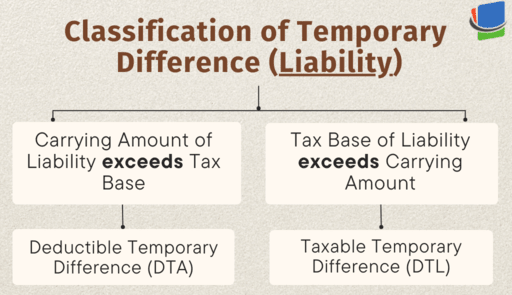

In order to recognize DTA/DTL, firstly we need to calculate the Temporary Difference.

*(Refer to Part I for the tax base)

Temporary differences can be classified into - Taxable temporary differences & Deductible temporary difference

Note: If the Carrying Amount equals the Tax Base, then no temporary difference arises.

Ind AS 12 requires the recognition of all Deferred Tax Liabilities - DTL (except in certain circumstances).

However, an entity recognizes Deferred Tax Assets - DTA only when it is probable that taxable profits will be available against which the deductible temporary differences (DTA) can be utilized.

Alternatively, if the entity has tax planning opportunities that can create taxable profit in suitable periods, the deferred tax asset may also be recognized.

Tax planning opportunities are actions that the entity would take to create or increase taxable income in a particular period before the expiry of a tax loss or tax credit carryforward.

Unused tax losses and unused tax credits

A Deferred Tax Asset (DTA) shall be recognized for the carryforward of unused tax losses and tax credits to the extent that it is probable that future taxable profits can offset these unutilized amounts.

This is primarily because the presence of unused tax losses indicates that future taxable profit might not be attainable.

Reassessment of unrecognised deferred tax assets

At the end of each reporting period, an entity reassesses unrecognized deferred tax assets. If it becomes likely that future taxable profit will enable the recovery of the deferred tax asset, the entity will recognize a previously unrecognized deferred tax asset to the extent deemed probable.

Measurement

Ind AS 12 requires entities to recognize a current tax liability or asset for the estimated amount of taxes payable or recoverable for the current year.

An entity measures deferred tax liabilities and deferred tax assets using the tax rate and the tax base that are consistent with the expected manner of recovery or settlement.

Example: An item of property, plant, and equipment has a carrying amount of Rs. 100 and a tax base of Rs. 60. A tax rate of 20% would apply if the item were sold, and a tax rate of 30% would apply to other income.The entity recognizes a deferred tax liability of Rs. 8 (Rs. 40 at 20%) if it expects to sell the item without further use and a deferred tax liability of Rs. 12 (Rs. 40 at 30%) if it expects to retain the item and recover its carrying amount through use.

Deferred tax assets and liabilities shall not be discounted. Additionally, the carrying amount of a deferred tax asset must be reviewed at the end of each reporting period to check whether any deferred tax asset has to be de-recognized since it is no longer probable that sufficient taxable profit will be available or any unrecognized deferred tax asset has to be recognized since it becomes probable that sufficient taxable profit will be available.

Continue reading Part III on Decoding Ind AS 12 here.